Winter Wheat Costs of Production: Signs of Stability After Volatility

Rebecca Geraghty

Farms are balancing immediate operational decisions with planning for the season ahead and beyond, shifting from short-term agronomy decisions to longer-term budgeting and rotation planning.

Understanding how costs, yields, and margins have moved over time is critical to building a realistic budget and making confident decisions for the year ahead. Using your own verified data, alongside benchmark insights from across the industry, helps move planning beyond instinct and short-term reactions towards a more structured, multi-year view of performance and opportunity.

The analysis shared here is drawn directly from YAGRO’s dataset, representing anonymised, validated information from farms across the UK, with a skew towards the east of the country where arable cropping is most prevalent. Every data point has been checked and standardised, and results are only published where there is a statistically significant sample size. No individual farm data is ever shared.

Where a year is referenced (for example, Winter Wheat 2025), this refers to the harvest year. Spend for a 2025 winter wheat crop will have largely occurred during the second half of 2024.

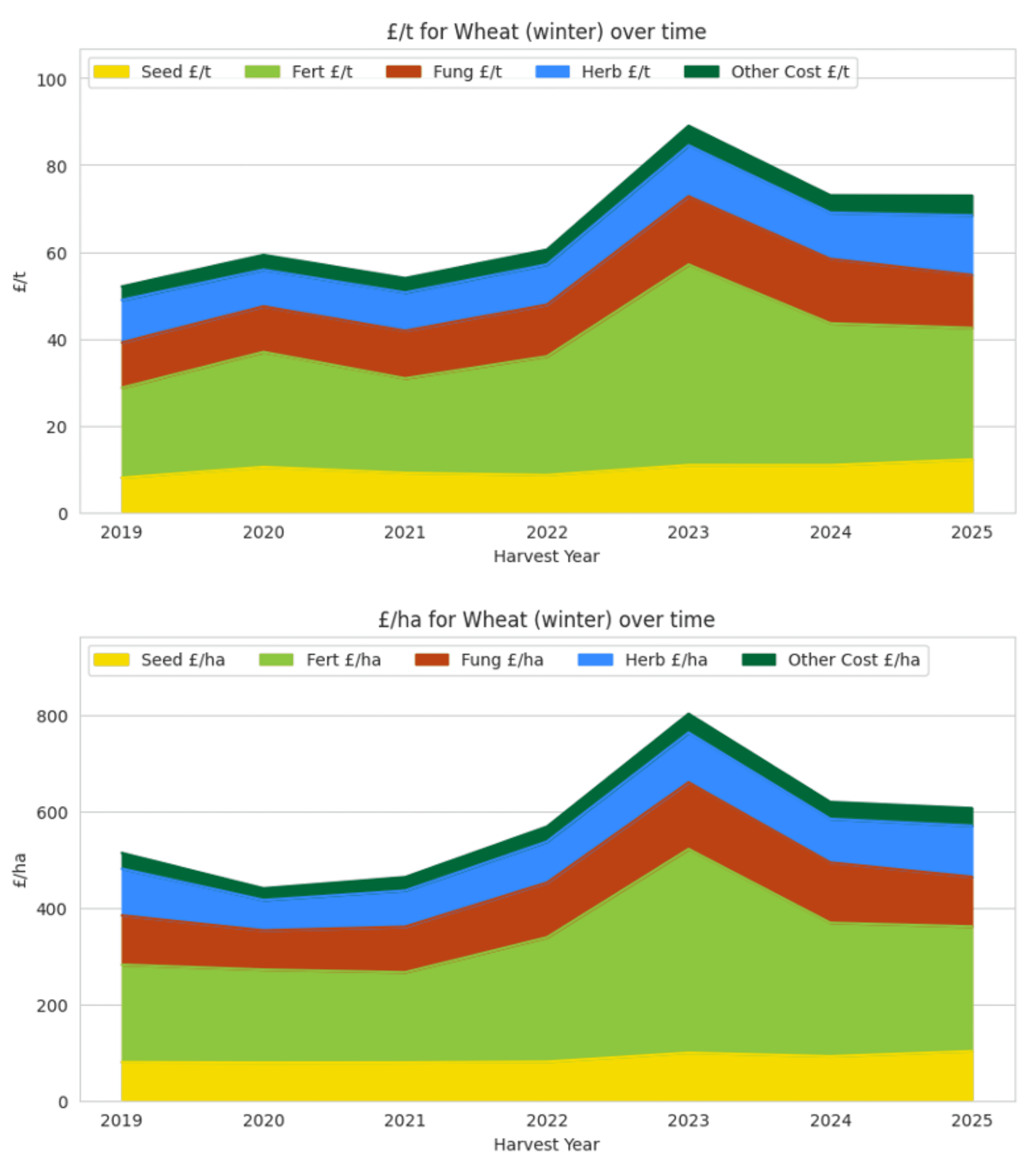

Costs of Production: A Plateau After the Peaks

The data shows that winter wheat fertiliser spend has stabilised following the sharp reductions seen in the previous year. The steep fall in nitrogen price (£/kg) that drove lower costs in 2024 appears to have levelled off.

Median fertiliser spend dropped from £278/ha in 2024 to £250/ha in 2025, suggesting the market may be approaching a new baseline rather than continuing its downward trend.

Fungicide costs also fell, moving from a median of £125/ha to £99/ha. In contrast, herbicide spend increased by an average of £12/ha across all wheat types, while seed costs rose slightly from £92/ha to £101/ha.

Overall, these inputs are now acting as relatively stable components within most arable rotations, following several years of volatility.

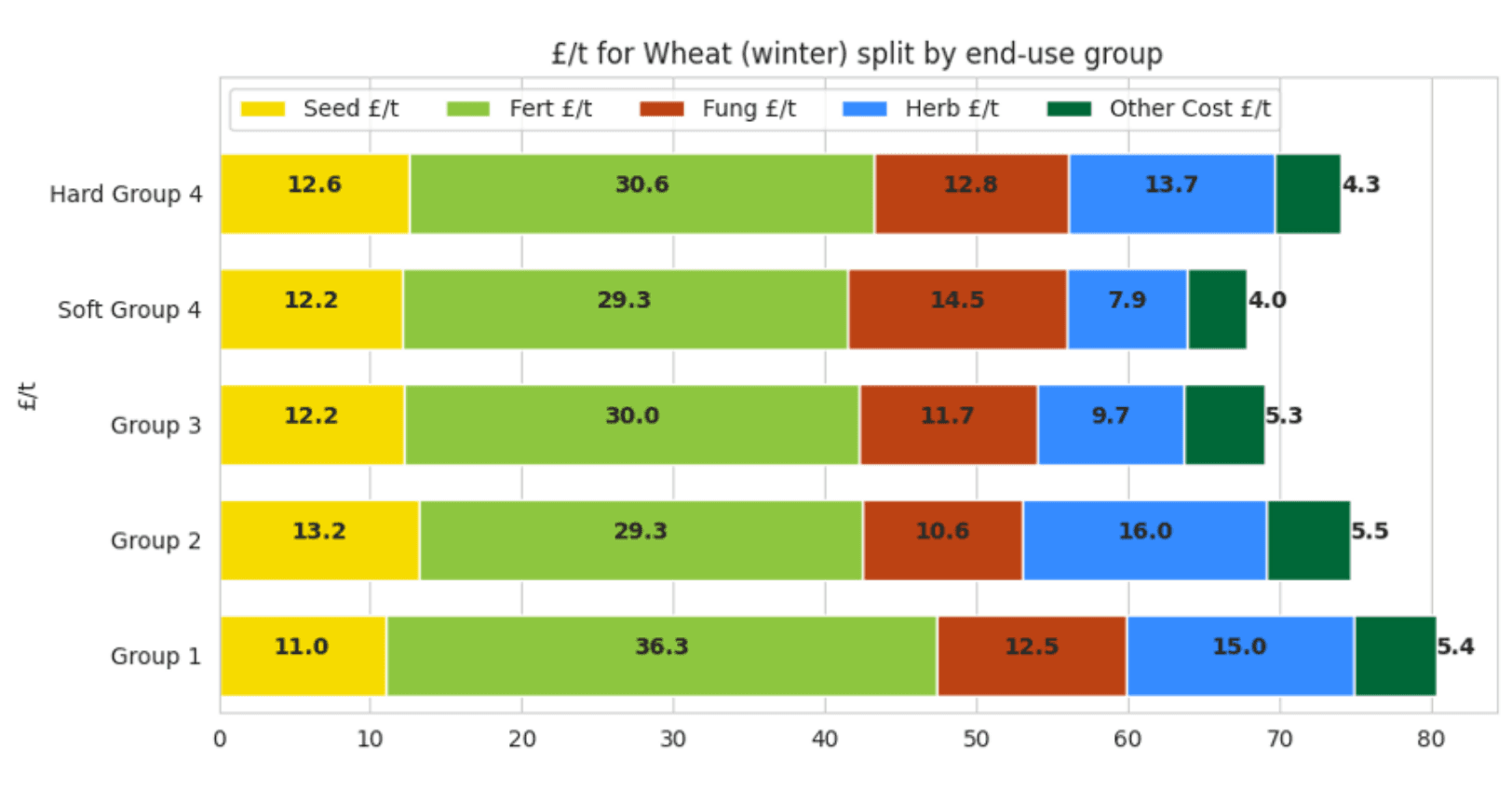

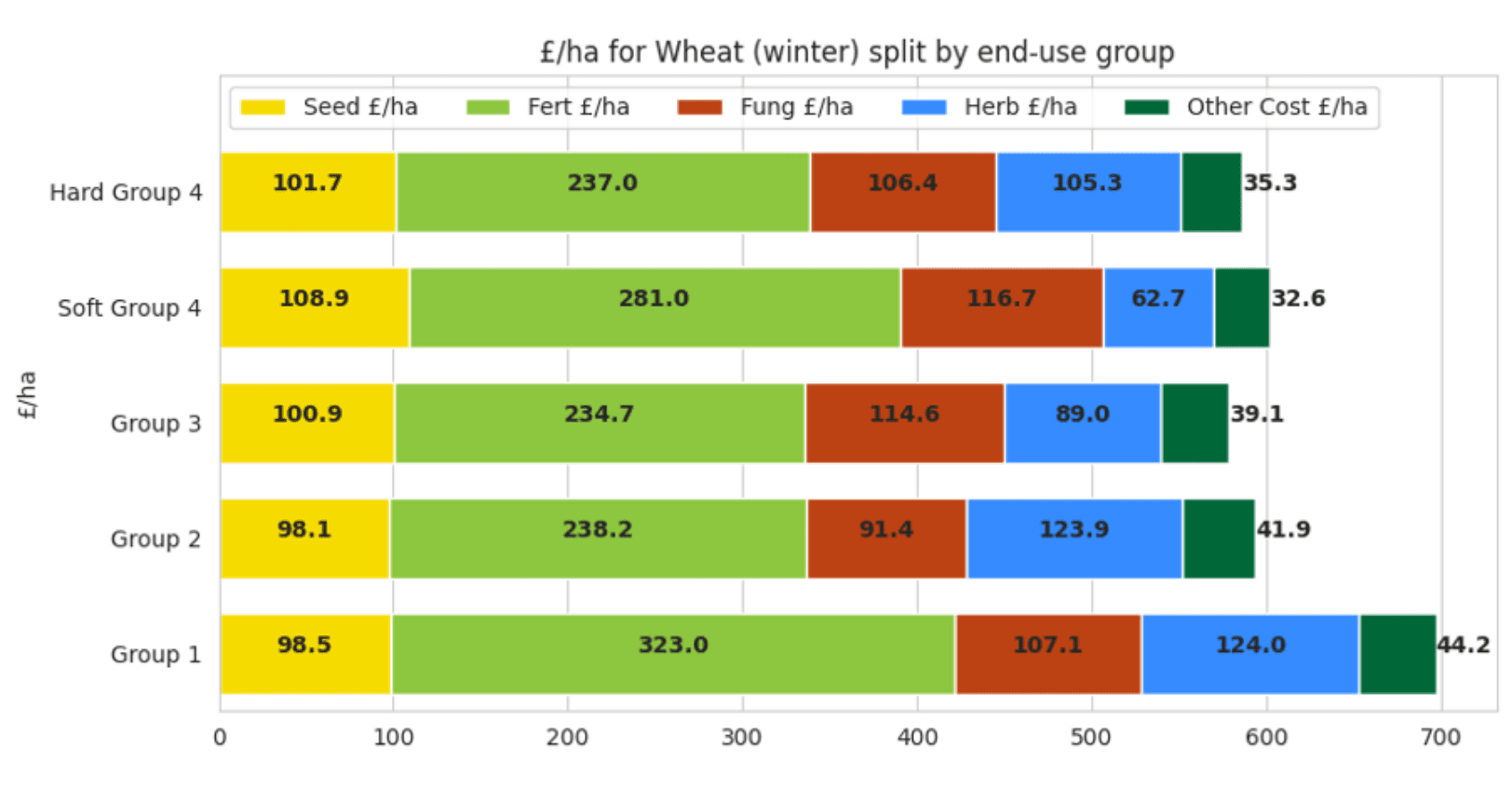

End-Use Group Performance

Group 1 wheats show higher average spend per hectare and per tonne, though increases are smaller when expressed on a per-tonne basis. Seed costs appear lower for Group 1 varieties, likely reflecting a higher proportion of farms using home-saved seed.

Group 3 wheats demonstrate tighter cost-per-tonne consistency, indicating more predictable cost efficiency across a wide range of growing conditions.

Note: “Other costs” include insecticides, trace elements, adjuvants, water conditioners, molluscicides, and similar inputs. These typically make up a small proportion of overall spend and vary significantly by farm practice, with some farms applying none at all.

Next, we break down how these cost trends play out at a varietal level in Winter Wheat Varieties: Yield, Cost and Popularity in 2025.

Rebecca Geraghty is Managing Director of YAGRO, the farm and supply chain data and analytics specialists. She is a commercial leader with more than 20 years’ experience spanning agricultural data, innovation, regenerative farming and national-scale advisory programmes. Rebecca has delivered data platform sales for the Cabinet Office, Defra and the Environment Agency, and helped develop a global regenerative agriculture platform supporting 300,000+ farmers. She previously held senior technical and leadership roles at AHDB, including six years as Director of the Home-Grown Cereals Authority. Rebecca lives and works on her family livestock farm, keeping her perspective grounded in the realities of farming.